Portugal’s Fashion Renaissance: From Europe’s Struggling Workshop to Rising Star

Against the backdrop of the upcoming presidential elections on January 18th, Portugal is amplifying its international presence, showcasing macroeconomic stability and a strategic reevaluation of its role in the global fashion supply chain.

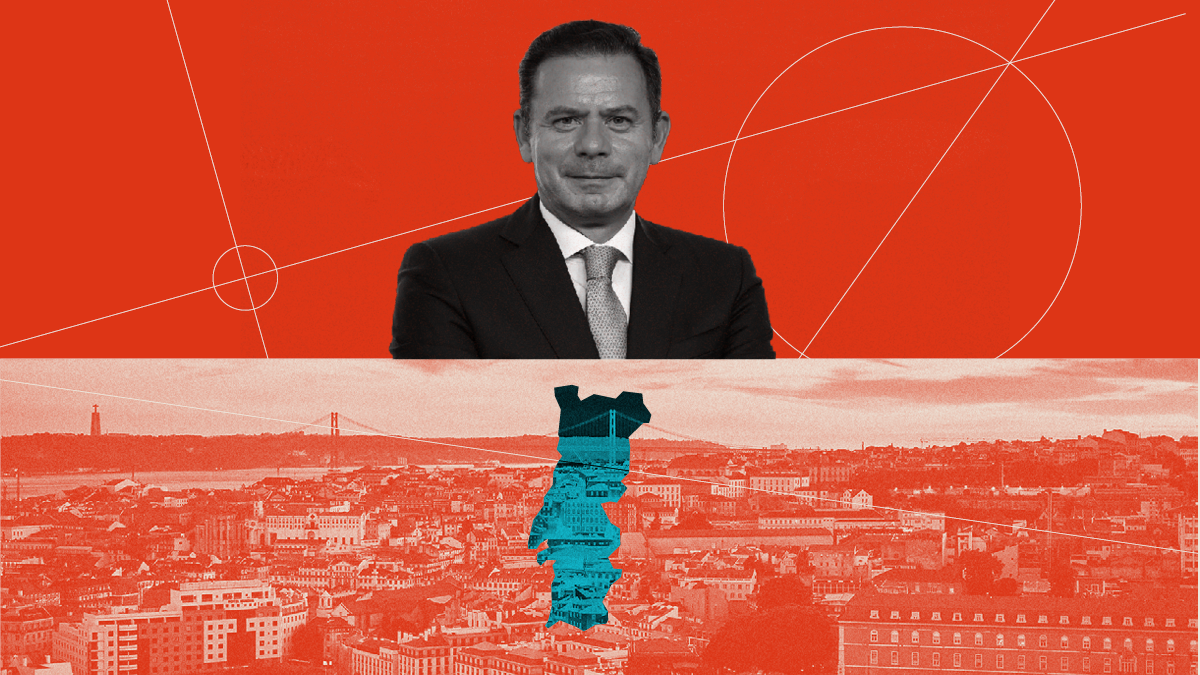

Portugal returns to the polls at a key moment for its economy and its role in the European fashion industry. The first round of the presidential elections is scheduled for January 18th and André Ventura, of the far-right Chega party, is the favorite, followed by the socialist António José Seguro and the social democrat Luís Marques Mendes. According to the polls, none of them seems to have enough majority to avoid a second round.

The winner will lead a country whose economy presents a mix of structural stability and new challenges: in fashion, the present is marked by the crisis of several industrial operators in the country, as well as the growth of the handful of national champions in the sector.

The upcoming elections are taking place in a macroeconomic context marked by sustained fiscal consolidation after years of adjustments and growth which, although moderate, is above the average figures for the Eurozone, according to the European Commission’s latest forecasts. This joint political and economic scenario makes Portugal a relevant case study for strategic sectors such as fashion, which are looking for mature markets with solid fundamentals.

In terms of growth, the Portuguese economy recorded a Gross Domestic Product (GDP) advance of 1.9% in 2024, remaining above the euro average and consolidating a sustained expansion trend since the post-Pandemic recovery. The European Commission’s official projections point to continued growth of 1.9% in 2025 and 2.2% in 2026, driven mainly by domestic demand and the absorption of European Union (EU) recovery funds, with unemployment projected at around 6.3% by the close of 2025 and 6.2% by 2026. As for inflation, it will remain moderate at around 2.2% by 2025 and 2% in 2026, in line with the European Central Bank’s targets.

Inflation has been on a moderating trajectory following peaks in recent years, to around 2.7% in 2024 and gradually bringing it to lower levels that favor consumption and business planning in the medium term. In addition, the current account balance remains in positive territory, reflecting the resilience of the external sector in the face of a global environment marked by trade tensions and volatility. Public debt, although still high, continues on a clear downward path, with forecasts placing it below 90% of GDP in 2026, a substantial improvement over the levels observed in the last decade.

The European Commission’s official projections point to continued Portuguese GDP growth of 1.9% in 2025 and 2.2% in 2026

The strength of the Portuguese labor market is another pillar of its macroeconomic stability: job creation has been robust and has contributed to reducing unemployment towards lows of recent years, while rising disposable income has supported a recovery in household spending. With a population of over 10.4 million and a labor force of over 5.6 million workers, the country combines a stable demographic base with social indicators, such as a poverty risk rate below the European average, that underpin a domestic market with sustained consumption potential.

A market of interest for fashion

As the eighth largest economy in the euro zone, Portugal is a natural mature market for international groups in the sector, which often set up subsidiaries and structures for the Iberian market as a whole. International groups such as Primark, Dior and Louis Vuitton are present in Lisbon (with 2.9 million inhabitants in its metropolitan area) and Porto (1.3 million).

Portugal is a particularly target market for Spanish groups, which often have the Portuguese country as the first stop in their international expansion plans. Inditex opened the first international Zara store in Portugal in the 1980s and now has more than 50 stores. Mango, which also began its internationalization in Portugal, has some thirty stores, led by its store on Avenida da Liberdade in Lisbon. El Corte Inglés has its only international centers in Portugal, in Lisbon and Gaia, in Oporto.

European ‘Nearshoring

From the production point of view, Portugal occupies an intermediate and increasingly tense position in global fashion sourcing, especially from the point of view of Spanish brands. The country is part of the classic trio of local sourcing (along with Turkey and Morocco), but its relative weight has been eroded in recent years.

The textile and footwear industry currently accounts for around 2% of Portugal’s national GDP, employs more than 130,000 people and brings together a fabric of more than 5,400 companies, concentrated mainly in the north of the country, while exports exceed 6 billion euros a year. For decades, the visible face of the country has been to assert itself as a reliable and relatively accessible production center. Now Lisbon is trying to shift its focus to design, relying on a generation of creators who no longer want to limit themselves to manufacturing for others.

Portugal is part of the classic nearsourcing trio (along with Turkey and Morocco), but has been losing ground in recent years

With a strategic proximity to Galicia, where Inditex has its headquarters, Portugal is a key sourcing pole in the nearshoring of European groups. Spanish purchases of fashion to the Portuguese country have been maintained for years in the vicinity of 900 million euros (taking into account data from the first three quarters of each year). From January to September 2025, Portuguese fashion exports to Spain fell by 1%, to 882 million euros.

In this scenario, Portugal remains a strategic partner for European brands because of its speed, flexibility and logistical proximity, but the purely industrial model shows signs of having reached its ceiling.The crisis of the industrial giant Polopiqué is a warning sign for the country’s industry: last year the company, a benchmark in the clothing industry in northern Portugal, with exports to fifty countries, was forced to close two of its plants and lay off 280 workers. The company, which maintains other active divisions focused on design, logistics and finishing, attributes the crisis to the effects of the pandemic, the rising cost of energy and raw materials, and the pressure from Asian low-cost producers and platforms such as Shein or Temu, highlighting the limits of the traditional Portuguese industrial model.

The textile and footwear industry represents 2% of the national GDP in Portugal, employing more than 130,000 people in more than 5,400 companies.

In distribution, retail giant Sonae for years agglutinated its own brands such as MO and Zippy within its fashion division. In 2025, Sonae agreed and completed the sale of its MO and Zippy fashion businesses to a consortium led by MO’s current management and the Mercúrio fund (managed by Oxy Capital), in a management buy-out transaction that involved the sale of its MO and Zippy fashion businesses to a consortium led by MO’s current management and the Mercúrio fund (managed by Oxy Capital).20 million for the group and reflects Sonae’s shift in strategic focus towards a more active management of its business portfolio.

In fashion, Parfois is probably the case with the greatest international projection: it took its first steps in 1994 under the leadership of Manuela Medeiros. The company is headquartered in Porto, and since 2025 has been led by Spaniard Luis Maseres, who is CEO. With a turnover of around €1 billion, a presence in more than 70 countries and more than 1,050 stores globally, Parfois has expanded its business with new channels and through partners in Italy, France, Turkey, Saudi Arabia, Mexico, Vietnam and Israel. And it has continued its global expansion recently with new openings in Athens, Lima and Barcelona.

In the ready-to-wear and denim segment, brands such as Salsa Jeans and Tiffosi have achieved national and international notoriety. Other national firms are growing with specialized proposals and, in some cases, exportable niches. This is the case of Sacoor Brothers, a luxury fashion retailer based in Lisbon. There are also designer brands with a creative profile and projection on international platforms, such as Marques’Almeida, founded by Portuguese designers in London and recognized in global fashion circuits.

Parfois is the Portuguese brand with the greatest international projection: 1 billion in turnover and some 1,050 stores in more than 70 countries

More design and less production

Portugal is seeking to redefine its role in the European fashion value chain and aspires to stop being seen only as “the factory of Europe” and to gain weight in design, authorship and own brands. The emergence of a new creative generation and the industrial proximity of the north are making it possible to accelerate the transition from concept to product and strengthen the international competitiveness of Portuguese designers.

Initiatives such as ModaLisboa and its Sangue Novo program connect training, creativity and industry, consolidating the catwalk as a professional tool and launching pad for names with global projection such as Marques’Almeida or Constança Entrudo.

The challenge, agree industry agents and employers’ associations such as the Associação Têxtil e Vestuário de Portugal (Atp), is to consolidate structures capable of scaling up, financing themselves and sustaining collections over time, in an environment marked by sustainable transition and labor pressure. Portugal is not abandoning its role as a strategic manufacturer, but is increasingly seeking to decide what it produces and to sign a growing part of that production under its own brand, reinforcing the added value of made in Portugal beyond its industrial muscle.