Luxury’s Shift: From Pyramids to Skyscrapers as U.S. Beckons Amid Trump Era

Amid the luxury downturn, as Bain warns of disillusioned clients and dwindling shoppers, Chanel, Louis Vuitton, Gucci, and Dior set sail for the American dream with their cruise collections, navigating tariff tensions and nodding to Trump.

Enter the name of a historic luxury maison belonging to a multi-billion dollar conglomerate, choose an exotic destination, add high notes of splurge in the form of lavish attention to the last detail and flood Instagram with pictures that will make the whole industry’s teeth curl. The result will be a cruise parade, a show in which what matters least is the clothes. In recent decades, these cruise collections have been the perfect alibi to get fashion on a business class plane. Every May, when the calendar relaxes between official seasons, the big houses have moved press, buyers and VIP clients to increasingly spectacular settings. From the pyramids illuminated at dusk to the imperial palaces in Seoul, from bridges over the Han River to the Plaza de España in Seville. The cruise as a scheduled trip to the most photogenic image possible, an expensive marketing campaign for a sector that has to return to efficiency.

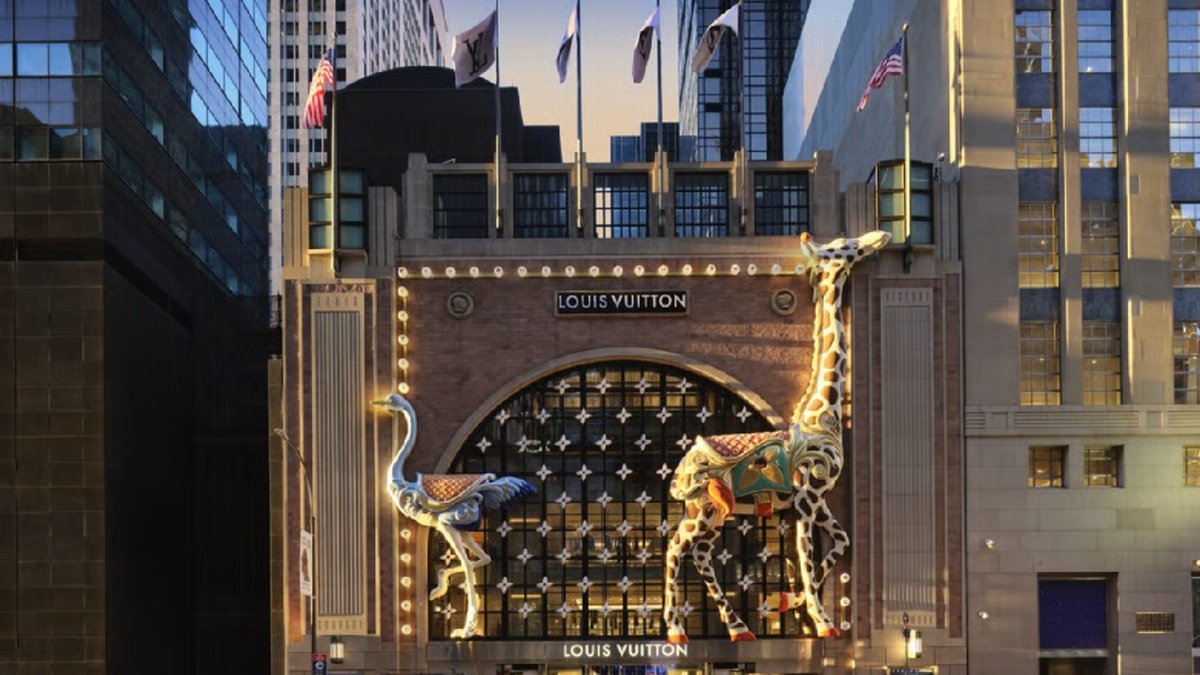

Louis Vuitton has, in recent years, taken this idea to the extreme. In 2019, Nicolas Ghesquière convened his guests under the white dome of JFK’s TWA Flight Center; before and after, the map was filled with architectural icons, with the Museum of Contemporary Art and the Louis VuittonThe map was then filled with architectural icons, with the Museum of Contemporary Art in Niteroi, the Miho Museum in Kyoto, Park Güell in Barcelona and the Palais des Papes in Avignon. Each show was a different postcard, a reminder that luxury could appear, for a few hours, anywhere in the world.

When Dior turned on the spotlight in front of the pyramids of Giza in 2022, with the men’s collection of its then creative Kim Jones, the image went around the world and condensed the spirit of the decade between archeology, spectacle and live fashion, in a calendar that needed headlines more than clothes. At the same time, each of these assemblies concentrated dozens of intercontinental flights, ephemeral structures erected and dismantled in days and an environmental footprint that the sector itself has begun to look at with some suspicion.

All this has continued to happen while inflation, geopolitical tensions and the cost of living have been on the agenda of the same clients who are invited to these private parties. The gap between the postcard narrative and economic reality becomes more visible when the numbers no longer follow. And suddenly, the geography of cruising begins to move across the pond, with fewer pyramids and more skyscrapers. Chanel, Louis Vuitton, Gucci and Dior have decided to concentrate cruises and Métiers d’Art, the Chanel show dedicated to their crafts and savoir-faire, in the United States, with New York and Los Angeles as epicenters, just when luxury is going through its most fragile moment in more than a decade and tariffs are still on the table in Washington.

The cruise collections land sign their global bet on the United States

Chanel’s case works almost as a prologue to this new stage. Just a few months after his debut under the dome of the Grand Palais, Matthieu Blazy has chosen New York as the setting for his first Métiers d’Art show for the house, this December 2. For the maison, it is not just any city, since Gabrielle Chanel traveled to Manhattan in the 1930s and Karl Lagerfeld presented one of his last collections there in 2018, at the Metropolitan Museum of Art.

The appointment of rapper A$AP Rocky as the house’s male ambassador accompanies the movement towards the United States and towards a specific culture. The musician embodies the synthesis between luxury, streetwear and hip hop scene that the late Virgil Abloh brought to the center of the industry from Louis Vuitton and that, with the turn of social networks and the rise of Asian stars, has lost its original strength. The message reflects that Chanel wants to speak again to the American customer, but also to the generation that has grown up watching sneakers and street codes finally enter the historic showcases of the industry.

Louis Vuitton will follow a similar script. Ghesquière will present the cruise 2027 collection in New York on May 20, 2026, with the location still under wraps. Gucci, owned by Kering, will also be heading to Manhattan. The brand has confirmed that it will present its cruise 2027 collection in the Big Apple on May 16, 2026, in what will be Georgian Demna’s first cruise for the Italian house. In the midst of a reinvention process, Gucci will connect in New York with its roots. It was there, in 1953, that it opened its first store outside Italy. Seventy years later, the cruise picks up that thread at a time when the U.S. market is once again at the center of the strategic chessboard.

Meanwhile, the counterplan is in California. Jonathan Anderson’s first cruise for Dior will be held on May 13, 2026 in Los Angeles, in a space to be announced but already connected to the new House of Dior Beverly Hills on Rodeo Drive, a four-story flagship with its own restaurant that reinforces the historic alliance between the maison and Hollywood. The runway show will build on that tradition, started by Maria Grazia Chiuri with the Calabasas show in 2017 and continued by Kim Jones at Venice Beach in 2023 alongside Eli Russell Linnetz, but under a unique creative direction that now encompasses women’s, men’s and Haute Couture.

From Fifth Avenue to Rodeo Drive

The map is eloquent. In just weeks, luxury fashion will travel up Fifth Avenue and down Rodeo Drive, while groups and analysts look askance at the evolution of demand in other markets. The United States thus turns the postcard around, asserting itself as the place where the industry continues to see spending power, both in the big capitals and in a constellation of second-tier cities with high rents and lower operating costs.

According to Bain, after a virtually flat 2025, the luxury personal property market will only grow between 3% and 5% in 2026 and will do so supported largely by inertia in the U.S., local demand in Europe and Japan, and gradual improvement in China. The consultancy puts the size of the market at around €358 billion and recalls that each point of growth is fought over much more than a decade ago.

Other reports, such as that of RBC Luxury Datawatch, underline that North America concentrates around 22% of world luxury sales and around a third of the global sportswear business. Added to this is shopping tourism, which keeps the U.S. customer as the first nationality in tax-free spending in Europe, according to Global Blue.

Looking at the situation from the offices of a listed group, moving a cruise ship from a remote island to a mature market makes sense. Gathering high-spending clients in Manhattan or Beverly Hills shortens flights and reduces the logistics bill, but above all it allows the fashion show to be linked to in-store appointments, shopping sessions and ambassador events without leaving an ecosystem where there are local teams, newly opened flagships and a dense network of outlets. The trip is better integrated into the bottom line.

Luxury today seeks to better monetize its ‘cruise’ proposals

The role of the cruise has also changed hands. A decade ago, the main objective was to impress the press and buyers with all kinds of attentions, a kind of candy out of the stress of the fashion week season. Today the focus is on high-spending clients who can single-handedly tip the figure for a season. Turning travel into an experience designed for this core group of consumers, in their own market and their own time zone, is more important than adding another line to the list of exotic destinations in the brand archive.

According to the latest Bain study, the luxury customer base has gone from about 400 million people in 2022 to about 340 million in 2025 and could still lose an additional 20 to 30 million. In parallel, the weight of big spenders has increased to almost half of the market, but their aggregate spending has stopped growing. When it is precisely they who hold more than 40% of the business, the fact that they are lifting their foot off the accelerator is no longer a nuance but a warning.

The consulting firm uses an unusual word in this type of report: betrayal. After years of aggressive price increases, many aspirational buyers and part of the higher income clientele perceive that the value offered by the brands does not accompany the new step. Bain speaks of an industry “that has abandoned Generation Z” and has left a vacuum in the affordable luxury segment, a space that has been occupied by brands, in many cases American, while the big groups looked up.

The slowdown is also seen in stores. Bain estimates that stock-to-sales ratios are three to four points above 2019. Clearing inventory becomes a tricky problem in a sector where the destruction of unsold product is banned in the European Union and the use of off-price channels clashes with decades of narrative about control and scarcity. Seen from the inside, the accounts no longer come out as they used to and every parade, every square meter and every new product line has to find a concrete justification beyond the photo.

Geopolitics adds another layer of uncertainty. Bain cites volatility linked to Donald Trump’s trade policies and doubts about the Chinese economy as factors complicating any forecast. Luxury, which for years has acted as if it is playing in a frictionless market, is forced to measure the impact of an additional tariff or interest rate change as carefully as it analyzes the performance of a collection.

The Texas factory and ties to Trump

In this context, the United States and Trump occupy a central position. In his second term, the president has once again put the possibility of new taxes on European products on the table. For groups such as LVMH, which generate around a quarter of their turnover in the United States, the country is both an indispensable market and a source of risk.

In 2019, Arnault and Trump shook hands in Texas, in front of the cameras, at the inauguration of a Louis Vuitton factory. The scene was then seen as a gesture of courtesy towards the Administration and even became a meme because of the US president’s exaggerated way of pronouncing Louis Vuitton. Six years later, LVMH has announced a second plant in the same state before 2027, in the midst of tariff discussions. Arnault even went so far as to reproach Macron’s management (who, in his view, did not reach out enough for an agreement with the United States). For the French billionaire, investment and local employment with currencies in exchange for stability in access to a market that the group cannot afford to lose. Thus, luxury diplomacy is as much about the catwalk as it is about the production line.

Kering moves in a different register but with a more severe concern, the conglomerate is obliged to ensure that every euro invested makes sense. The internal plan known as ReconKering, driven by Luca de Meo, combines reduced dependence on Gucci, selective store closures, revised pricing strategy and a search for synergies between brands. The group’s target is to return to growth in about eighteen months and to return to top financial performance in about three years, making a move away from exoticism a pragmatic decision.

In the years of the pandemic and the first cycle of tariff threats, there were those who wondered whether luxury should distance itself from the United States and turn to Asia or whether it was prudent to slow down openings and reduce exposure in a market so exposed to politics. There was even speculation about schedules without major shows on U.S. soil, with a more discreet strategy and less dependent on U.S. consumption. Three years and several elections later, reality has set in, with the United States at the center of the map and cruise ships placed where demand has proven to be more resilient.