Bolivia’s Political Shift: Unveiling a New Frontier for Fashion

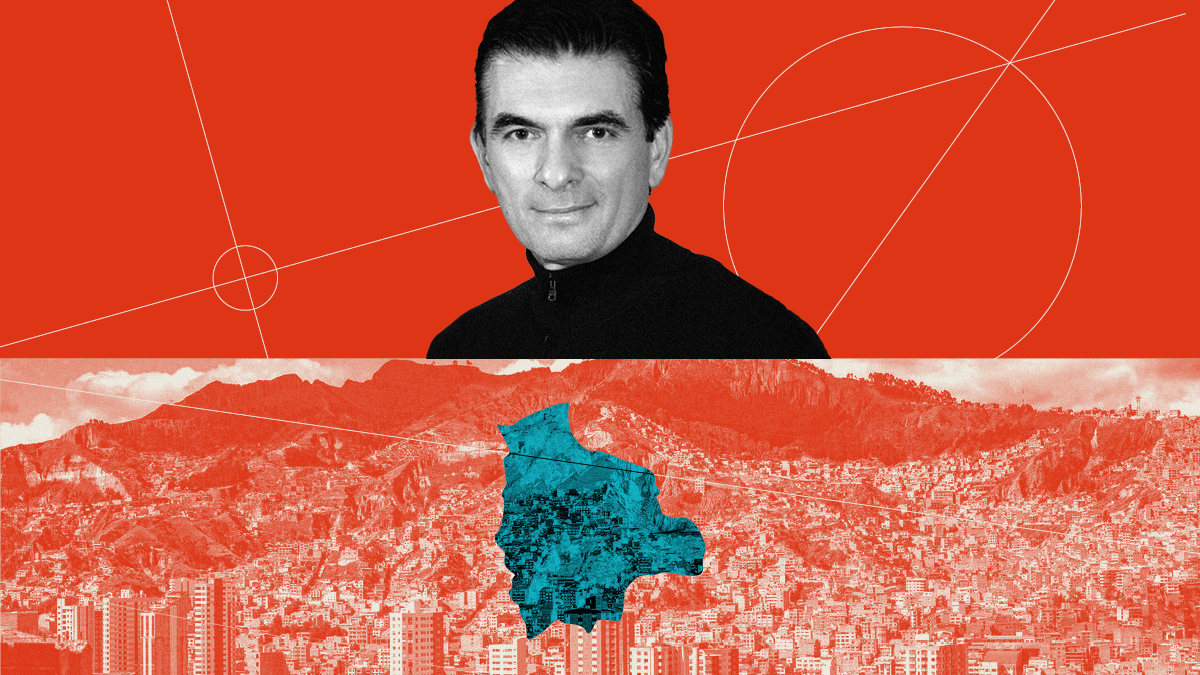

With a population of eleven million and a GDP per capita trailing its Latin American counterparts, Bolivia ushers in a new political dawn with Rodrigo Paz, the first centrist leader in two decades.

In Plaza Murillo in La Paz, Bolivia, the clock on the country’s Congress building has been turning upside down for more than ten years. Since 2014, the hands of the Bolivian capital’s clock have been turning to the left, as a symbol of the recovery of Andean identity and decolonization of the region’s countries.

This small act of governmental rebellion is framed in the history of a country that grew and prospered in the heat of Spanish silver extraction, especially intense in Potosi, and that, just as quickly, began its fall with the end of the stocks of this precious material. At more than 3,600 meters above sea level, La Paz, Bolivia’s administrative capital, rises in the Andes as the highest country capital in the world. In a location that cannot be described today much better than dysfunctional, an impressive skyline is overshadowed by narrow, steep streets, heavy traffic and a general lack of oxygen due to the altitude that makes even the smallest task difficult for anyone who has not been born and lived in La Paz for years.

That a city with these characteristics is today, together with Sucre, the capital of the country, is intrinsically related to Bolivia’s colonial past. The proximity of La Paz to Potosí, which was one of the largest cities of the Spanish empire in America, as well as its difficult access (which, at that time, was a defensive factor to be taken into account) played in favor of the development of the city of La Paz. This same relationship with the city’s past was part of the government’s decision a decade ago to launch the “southern clock”.

A few weeks ago, Bolivians elected a new president, Rodrigo Paz, candidate of the Christian Democratic Party (PDC) and closed almost two decades of government by the Movement Toward Socialism, the historic party of Evo Morales, which turned back the hands of the clock. In his turn to the center, Paz has already been congratulated by other countries in the region, most of which also have center-right governments, and especially by the United States, which has pledged to offer its support to “stabilize” the Bolivarian economy.

A complicated ‘macro’ picture

Paz, who will officially take office on November 8th, inherits an accumulated inflation rate up to September of 18.3%, well above the 7.5% projected for the whole year. The worst indicator, however, is reflected in the 2.4% contraction of the country’s economy in the first half of 2025, the first in almost 50 years.

With a population of 11.3 million inhabitants and one of the highest ratios of native population in Latin America, the International Monetary Fund (IMF) forecasts that the negative trend will be reversed in the second half of the year, with Gross Domestic Product (GDP) growth of a slight 0.6% at the end of 2025. For the following years, however, the international organization refrains from making predictions, due to the “significant uncertainty” in the evolution of the economy.

The estimated growth for Bolivia is, in fact, one of the lowest in the region, only surpassed by Venezuela, whose economy the IMF estimates a growth of 0.5%, and Puerto Rico, which will contract by 0.8% year-on-year. The country’s GDP at the end of last year stood at US$ 49.6 billion, with a per capita GDP of US$ 9,800, one of the lowest in Latin America.

In the rest of the main indicators, the IMF estimates an inflation rate of 20.8% year-on-year at the end of 2025, much higher than the 5.1% recorded the previous year, while the unemployment rate will increase by one tenth of a percentage point, to 5.1% at the end of the year. In both cases, the agency does not make forecasts for 2026 either.

Capitalism for all

To address the country’s economic and social problems, Rodrigo Paz has based his campaign on a key slogan: Capitalism for all. “Capitalism for all is the opposite of 21st century socialism”, explained the president in an interview to EFE shortly after his victory and as a clear message of antagonism to MAS and its main ideologue, Evo Morales.

The main axis of this strategy is to guarantee access to fuel, a commodity that has been scarce in the country for months and has generated much of the social discontent. Tax cuts, business credits and even import tariffs in certain key segments are other key issues that dominated the campaign of the current president.

A consequence of this slogan is also a greater internationalization of the country, a commitment that has already begun to take shape with the resumption of institutional relations with the United States. The North American power and Bolivia have not had relations since 2008 when the then president Morales expelled the US ambassador from the country, accusing him of supporting a conspiracy against his government.

Resuming relations with the United States first, and then with the rest of the international community allied with the giant, represents an opportunity for growth for the country, whose main clients today are Brazil and China. The main doubt surrounding Paz’s mandate, however, is the financing to implement these measures, in a country with a foreign debt that exceeded US$13 billion up to August and having ruled out an IMF loan.

Trade map

Bolivia exported goods and services for US$8,247.4 million at the end of 2024, according to the latest data from the International Trade Organization, 24.4% less than the previous year. Brazil is the country’s main client, receiving 16.9% of Bolivia’s foreign sales, followed by China and the European Union, with 14.6% and 10.4%, respectively. The United States ranks eleventh, with just 3.2% of total exports and a value of $261 million.

On the other hand, Bolivian imports reached a value of $ 8.21 billion, 28.5% less than in 2023. China and Brazil once again occupy the podium, albeit in inverted fashion, with the Asian giant being Bolivia’s main supplier, with 21.5% of total imports, and Brazil in second position, with another 14.8%. By products, the main goods exported by Bolivia are minerals and precious stones or metals, while the country mainly imports energy or manufactured goods such as vehicles or machinery.

In fashion, Bolivia mainly imports footwear items, according to the same WTO data, for a value of $58 million at the end of 2024, 0.72% of the total. This is followed by textile products, with a share of 0.3% of total imports and a value of almost $23 million, and knitted garments, with a value of another $17 million. Bolivian fashion exports, on the other hand, are scarce, a flow led by knitted garments and textile products, with a value of less than two million dollars.