Spanish Brand Silbon Expands to the US: Miami Store Launch Marks Path to €94 Million by 2025

The company will open a store in the Aventura Mall next November through one of its distributors in Latin America. The brand is also preparing to enter new markets such as Honduras, Peru, Guatemala, and Chile.

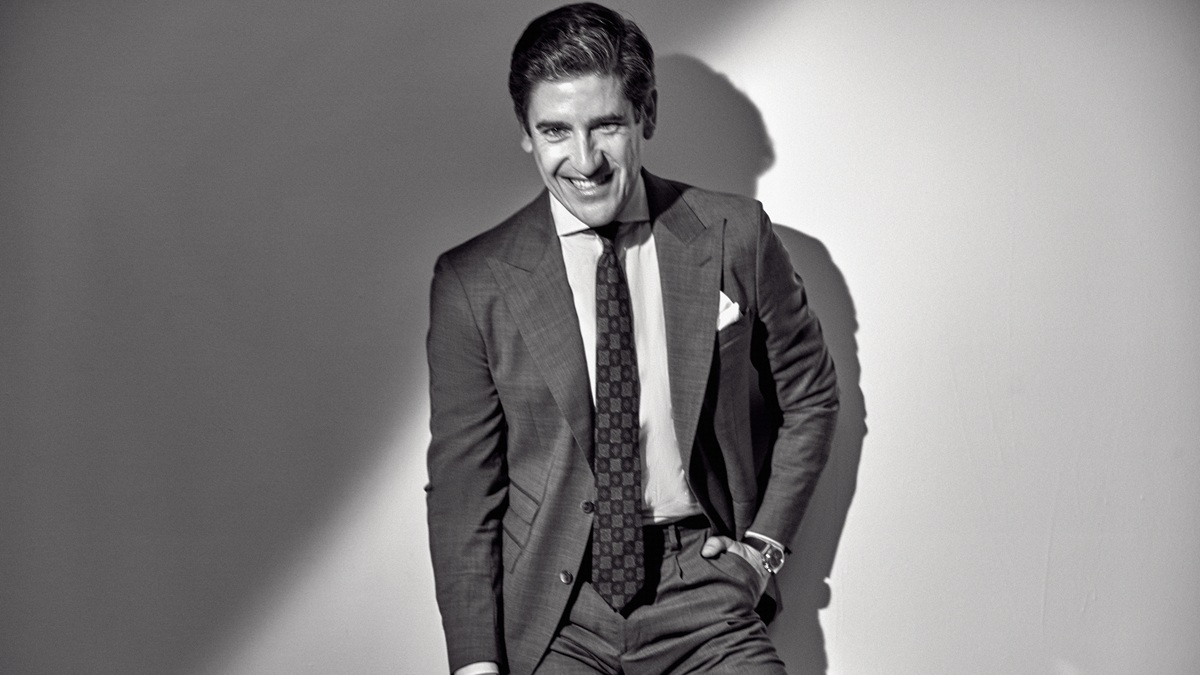

Silbon takes its brand into new territories. The Spanish company, which in recent years has carved out a niche in the men’s fashion segment, is finalizing its entry into the U.S. market with the opening of a store in Miami. The company, led and controlled by Pablo López, is thus boosting its international presence as it moves towards €94 million in turnover by 2025.

As explained to Modaes by the company’s founder, next November Silbon will open a store in the Aventura Mall, in a location next to Massimo Dutti, owned by Inditex. The company enters Miami through one of its distributors in Latin America, with a store of 1,300 square feet and only with the men’s line.

The expansion in Paris cost us, then we made the leap to Portugal and now our idea was to focus on Latin America, but we believe that our brand can fit in with the Miami public,“ explains López; “in our Serrano store we receive many customers from Latin America and the United States.

Silbon enters Miami with a store in Aventura Mall with a local partner

At the same time as it is testing the U.S. market, Silbon is accelerating its expansion in Latin America with local partners: in November it will open in Honduras; in December it will enter Peru with Ripley; in January it will open in Guatemala; and in the first quarter of 2026 it will open in Chile.

In addition to international growth, the company continues to focus on development in Spain. Silbon is finalizing the relocation of its store on Fuencarral Street in Madrid, which will move from 120 Fuencarral Street to 54 Fuencarral Street, an area where young brands such as Eme Studios and Blue Banana operate, as well as others that are direct competitors such as El Ganso and Scalpers.

Silbon, which began its development in 2009, plans to close the 2025 financial year with a turnover of close to €94 million, which will represent a growth of more than 44% compared to the €65 million it posted in 2023. From January to September, the company has increased its sales by 45%, 12% in comparable terms, according to data provided by its founder.

The company expects to close 2025 with a gross operating profit (ebitda) of 9% on sales, compared with the 10% it achieved in 2024. “The rain in March and April caused us to sell at a discount in the summer and we have invested more, as in eighty new stores in the last two years,“ says López.

The openings in the United States and Latin America are part of Silbon’s growth plan for 2025, which will close having added thirty stores to its distribution network, which exceeded one hundred points of sale at the end of 2024. After opening more than forty outlets in 2024, the company is beginning to slow down the pace of openings to focus investment on the digital channel and marketing. By 2026, the company plans between fifteen and twenty openings.

By the end of 2025, Silbon will implement its new strategic plan, which projects an average growth of 20% per year, reaching 180 million euros in sales in 2028.

Silbon’s strategic plan is based on four pillars. The first, digital growth: “we have been investing in capex for two years to open stores and now the investment will move to the digital channel for the international market,“ says López. The second is the maturation of the points of sale opened in recent years. Third, the maturation of the women’s line, which is growing at a rate of 60% a year. And fourth, the development of the multi-brand channel, both in Spain and abroad.

At the same time, the company is strengthening its structure. This week, Silbon has signed the expansion of its logistics center, located next to its headquarters in Cordoba. With this move, the complex will grow from 170,000 square feet to 140,000 square feet and will serve to provide coverage until spring-summer 2026. “Depending on growth, we will probably have to outsource,“ says López.