Lululemon’s Founder Pitches Three for Top Executive Position

As Chip Wilson seeks a new CEO, potential candidates from sportswear brand On, ESPN, or Activision are under consideration, with the company facing challenges in regaining its footing since his exit.

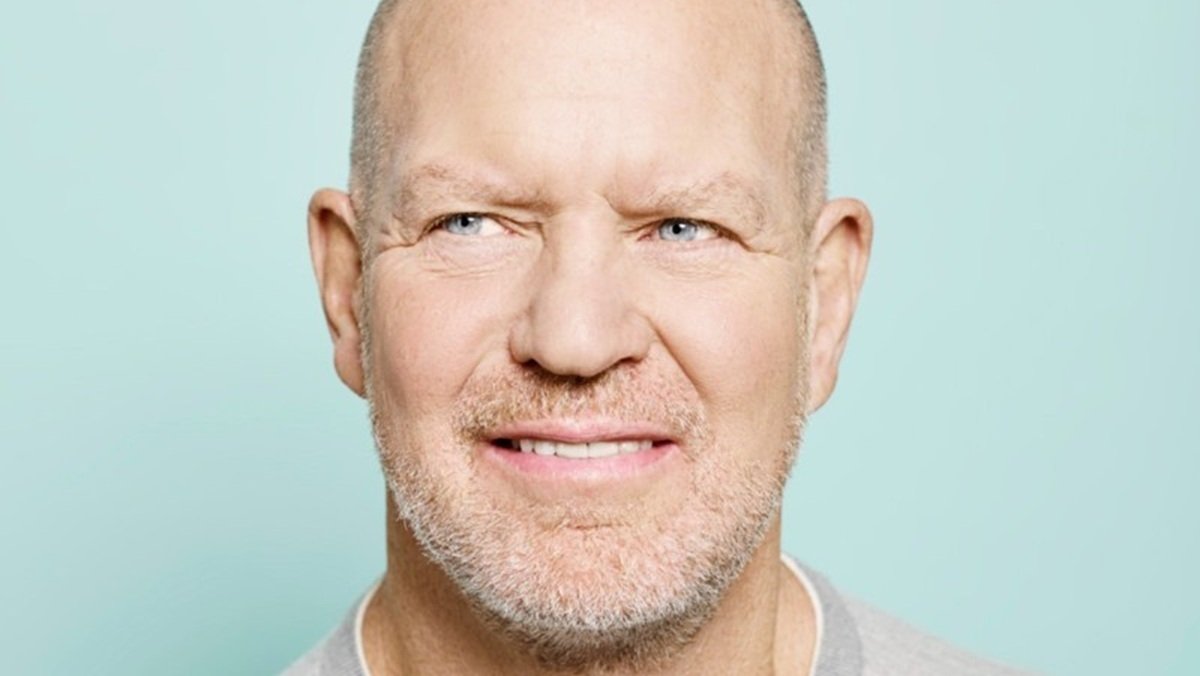

The founder of Lululemon, Chip Wilson, is making a move to secure the most important position in the sports equipment company: that of CEO. According to The Wall Street Journal, the businessman has proposed three candidates for the position.

Wilson has proposed Marc Maurer, former CEO of On; Laura Gentile, former marketing director of the U.S. television channel group Espn, and Eric Hirshberg, former CEO of Activision. The businessman is Lululemon’s second largest shareholder, with a stake of close to 9%.

Lululemon announced in December the departure of its CEO, Calvin McDonald, after seven years at the company, under pressure to turn the business around. Wilson, in fact, was one of the voices that pointed most strongly to the need for a profound change. The founder believes that shareholders will not trust any CEO proposed by the current board, so he has initiated the dispute for control of the board.

On the other hand, the Elliott Investment Management fund has accumulated a stake of more than one billion dollars in Lululemon and has announced its bet on Jane Nielsen, former Ralph Lauren executive, as the next CEO.

Wilson accumulates a 9% stake in Lululemon

Wilson stepped down as CEO of Lululemon in 2005, with the sale of 48% of the company to private equity firm Advent International. The company went public in 2007, with a valuation in excess of $1.2 billion.

The founder held the chairmanship until 2013, when a scandal over a television interview caused him to resign. He left the board for good in 2015 and, since then, up to four CEOs have tried to bring stability to the company.

Wilson later invested in Amer Sports, the Finnish sportswear parent company of outdoor brands such as Arc’teryx, Wilson, Salomon and Atomic; as well as in China’s Anta, one of the world’s largest sports industry groups, which is reportedly considering buying Puma.

The latest results recently published point to a two-speed fiscal year for Lululemon. The company posted a turnover of $2,565.9 million in the third quarter of the year, up 7% from the same period last year. However, its net profit fell by 12.8%, from $351.9 million in the third quarter of 2024 to $306.8 million in the same period of the current fiscal year.

For the first nine months of the year, Lululemon recorded a turnover of US$7,461.8 million, also up nearly 7%, while its net profit fell by 6.9%, dropping below $1 billion to $992.3 million.

The founder of Lululemon, Chip Wilson, is making a move to secure the most important position in the sports equipment company: that of CEO. According to The Wall Street Journal, the businessman has proposed three candidates for the position.

Wilson has proposed Marc Maurer, former CEO of On; Laura Gentile, former marketing director of the U.S. television channel group Espn, and Eric Hirshberg, former CEO of Activision. The businessman is Lululemon’s second largest shareholder, with a stake of close to 9%.

Lululemon announced in December the departure of its CEO, Calvin McDonald, after seven years at the company, under pressure to turn the business around. Wilson, in fact, was one of the voices that pointed most strongly to the need for a profound change. The founder believes that shareholders will not trust any CEO proposed by the current board, so he has initiated the dispute for control of the board.

On the other hand, the Elliott Investment Management fund has accumulated a stake of more than one billion dollars in Lululemon and has announced its bet on Jane Nielsen, former Ralph Lauren executive, as the next CEO.

Wilson accumulates a 9% stake in Lululemon

Wilson stepped down as CEO of Lululemon in 2005, with the sale of 48% of the company to private equity firm Advent International. The company went public in 2007, with a valuation in excess of $1.2 billion.

The founder held the chairmanship until 2013, when a scandal over a television interview caused him to resign. He left the board for good in 2015 and, since then, up to four CEOs have tried to bring stability to the company.

Wilson later invested in Amer Sports, the Finnish sportswear parent company of outdoor brands such as Arc’teryx, Wilson, Salomon and Atomic; as well as in China’s Anta, one of the world’s largest sports industry groups, which is reportedly considering buying Puma.

The latest results recently published point to a two-speed fiscal year for Lululemon. The company posted a turnover of $2,565.9 million in the third quarter of the year, up 7% from the same period last year. However, its net profit fell by 12.8%, from $351.9 million in the third quarter of 2024 to $306.8 million in the same period of the current fiscal year.

For the first nine months of the year, Lululemon recorded a turnover of US$7,461.8 million, also up nearly 7%, while its net profit fell by 6.9%, dropping below $1 billion to $992.3 million.