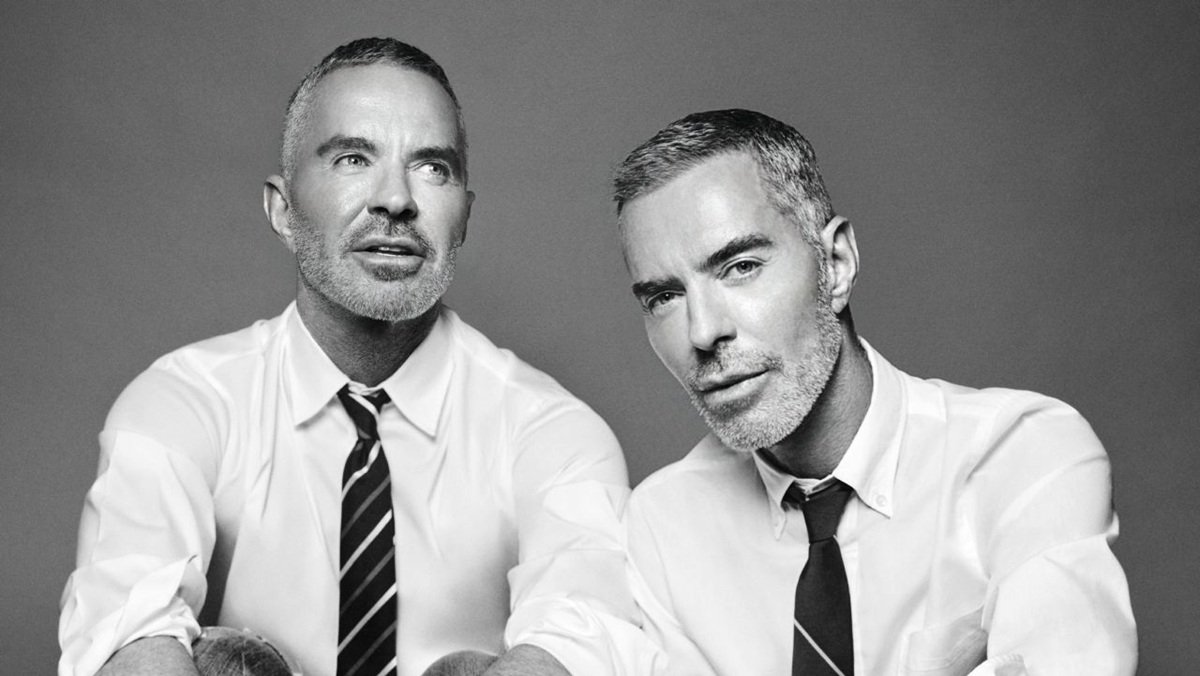

Dsquared2 Tightens Belt: Luxury Downturn Leads to 40 Job Cuts

The Canadian company succumbs to global industry pressures as major groups across the board slash headcounts. The move follows the internalization of its distribution efforts aimed at cost-cutting.

The luxury crisis continues to hit the industry. In this case, Dsquared2. The Canadian luxury company has announced a restructuring of its global business, which will involve cutting about forty jobs until the beginning of 2026.

In a statement, the company has cited its decision to the crisis facing the luxury sector globally. Specifically, it has stated that the company faces “deep and complex challenges” and said it faces the moment with “determination and clarity”.

The company insists that this is a “difficult” yet necessary decision to “strengthen the group’s operational structure” and ensure its long-term stability. The objective is to “consolidate the foundations for sustainable growth”.

Dsquared2 will cut up to forty jobs by the beginning of next year

This decision comes months after the company unraveled the legal dispute it has had this year with Staff International, the production arm of the OTB group with which it had a licensing agreement for the distribution of its articles, which Dsquared2 broke two years ahead of schedule. From 2027, the company will internalize the distribution of its products, with the exception of the children’s fashion line, which will continue to be licensed until 2030.

Dsquared2 is not alone. More companies in the sector are making cuts in their workforces to save their numbers. Britain’s Burberry, for example, announced a restructuring with approximately 1,700 jobs affected, 18% of its workforce. LVMH, meanwhile, will reduce Moët Henessy’s workforce by 10%, equivalent to around 1,200 jobs.

Luxury is reducing its sales and losing value

Luxury is going through its low hours. The sector’s most valuable brands have lost value over the year, according to the latest edition of Interbrand’s Best Globals Brands report. Gucci was the brand that lost the most value, while Adidas is the one that increased the most. The sixteen most valuable brands in the world have reached a combined valuation of €298 billion in 2025, a decline of 0.83% compared to the $301.1 billion they totaled twelve months earlier.

In general, most of the major luxury groups are seeing their results decline. LVMH, for example, closed the first nine months of the year with a turnover of €58.09 billion, 4% less than in the same period of the previous year, and an organic decline of 2%.

Chanel also joined the list in May, with a fiscal year 2024 that marked the first drop in sales since 2020, contracting its turnover by 4.3% to $18.7 billion, while also reducing its profitability.

Kering, for its part, also closed the first half of the year with a slump in turnover, in this case dragged down by Gucci. Its sales fell by 26%, to just over €3 billion.