Givaudan Nears 2025 Objectives with Strong High Perfumery Performance

The Swiss fragrance and flavor powerhouse has boosted its revenue by 3.4% in the first half, reaching 3.8 billion Swiss francs ($4.7 billion), driven by an 18% surge in its premium division.

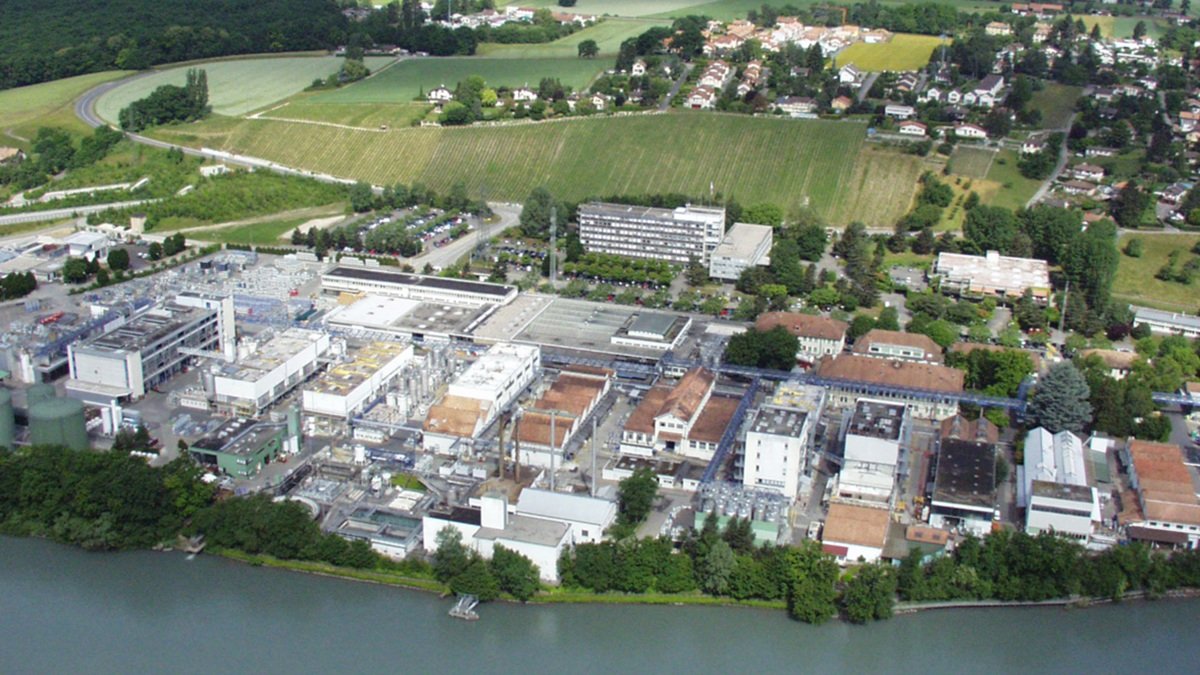

Givaudan is making steady progress towards its strategic objectives. The Swiss group, a world leader in the production of fragrances and aromas, closed the first half of the year with a turnover of 3.8 billion Swiss francs ($4.7 billion), an increase of 3.4% over the same period of the previous year. At constant exchange rates and excluding acquisitions, the increase was 6.3%, according to the Geneva-based company.

Net profit came in at 592 million Swiss francs ($743 million), up 0.7% year-on-year, slightly below the forecasts of analysts polled by the Swiss agency AWP, who had expected it to rise to 606 million francs.

The perfumery and beauty division was the main growth driver, with an increase of 8.6% at constant exchange rates. Within this unit, fine perfumery posted outstanding growth of 18%, reflecting the resilience of the premium segment even in a global context marked by inflation and geopolitical tensions. Functional perfumery, which includes products such as home fragrances, detergents and hygiene products, increased sales by 6.1%, while cosmetic ingredients grew by 5.7%.

The flavors division, which includes ingredients for snacks, beverages, ready meals and meat and dairy substitutes, posted growth of 4.1% at constant exchange rates. However, when accounting for the currency effect, sales fell 0.1% in Swiss francs, reflecting the impact of the strong local currency on international revenues.

Givaudan saw its fine fragrance division grow by 18%

In the statement, Givaudan stressed that the price increases implemented during the period have made it possible to offset “the increase in raw material costs in 2025, including customs duties.“ The company did not specify which markets or categories were most affected by these measures, but made it clear that it will continue to actively manage its prices to protect its profitability.

As for its strategic objectives, the group said it is “very likely to exceed the upper limit” of its growth target set for the 2021-2025 period. The company had targeted growth of 4% to 5% a year, but has averaged 7.2% over the past four years, driven mainly by the dynamism of high-end perfumery and the recovery of post-pandemic demand.

Givaudan, which competes with other major players in the sector such as Firmenich (merged with DSM) and Symrise, has maintained a strategy focused on innovation, sustainability and proximity to the end customer, strengthening its presence in emerging markets and focusing on natural and high value-added solutions.